These rules will take effect on October 1, 2025.

Qualification period

The qualification period is the time during which you must meet the income requirement. It begins the month before you apply for unemployment benefits and extends 12 months backward. To be eligible for benefits, you must also be registered with Arbetsförmedlingen. If you have not been able to work all 12 months due to, for example, illness, caring for children, or full-time studies, the qualification period can be extended by the same number of months you were unable to work. Read more about what can extend the qualification period here.

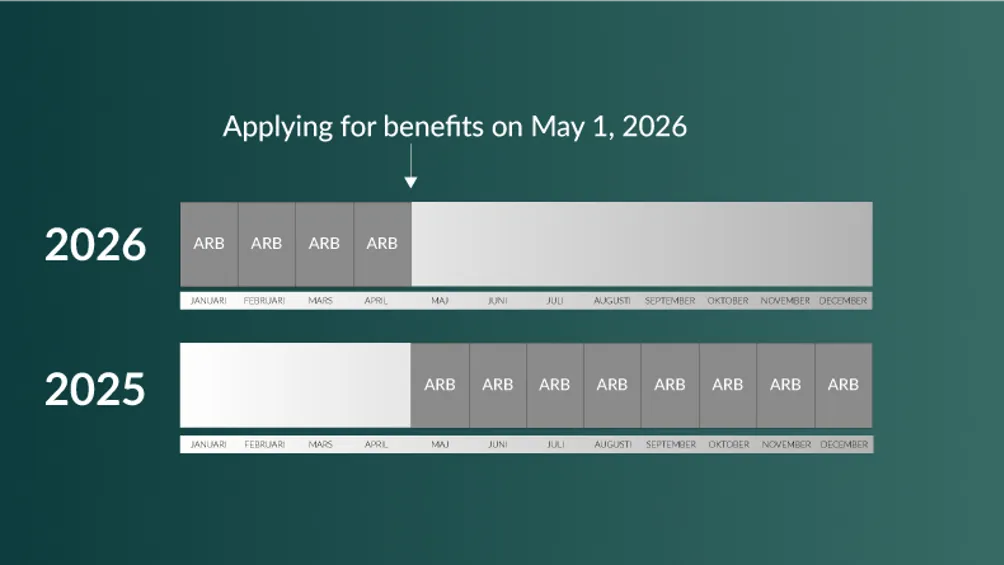

Kalle has worked during the past year. His qualification period is May 1, 2025 – April 30, 2026.

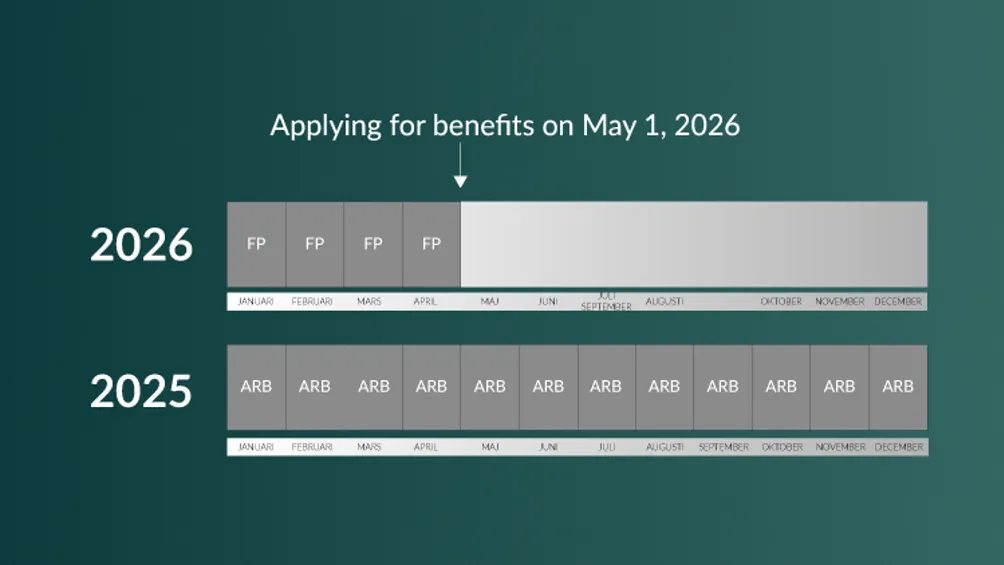

Filip has been on parental leave for four months. His qualification period is January 1, 2025 – April 30, 2026.

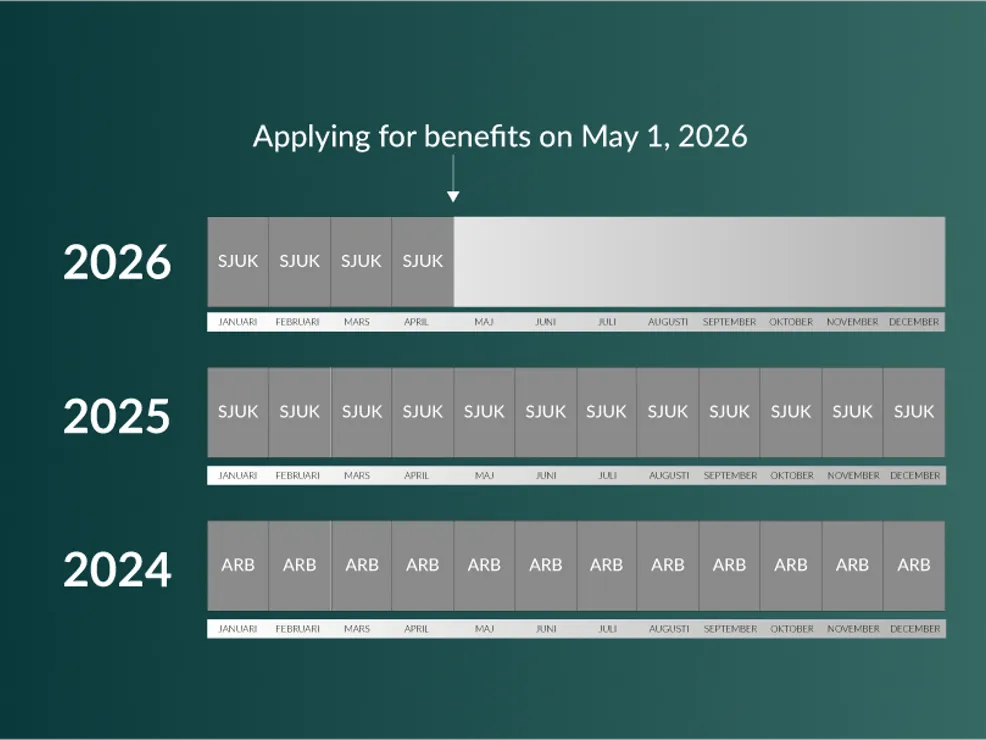

Anna has been on sick leave for 16 months. Her qualification period is January 1, 2024 – April 30, 2026.

Main rule

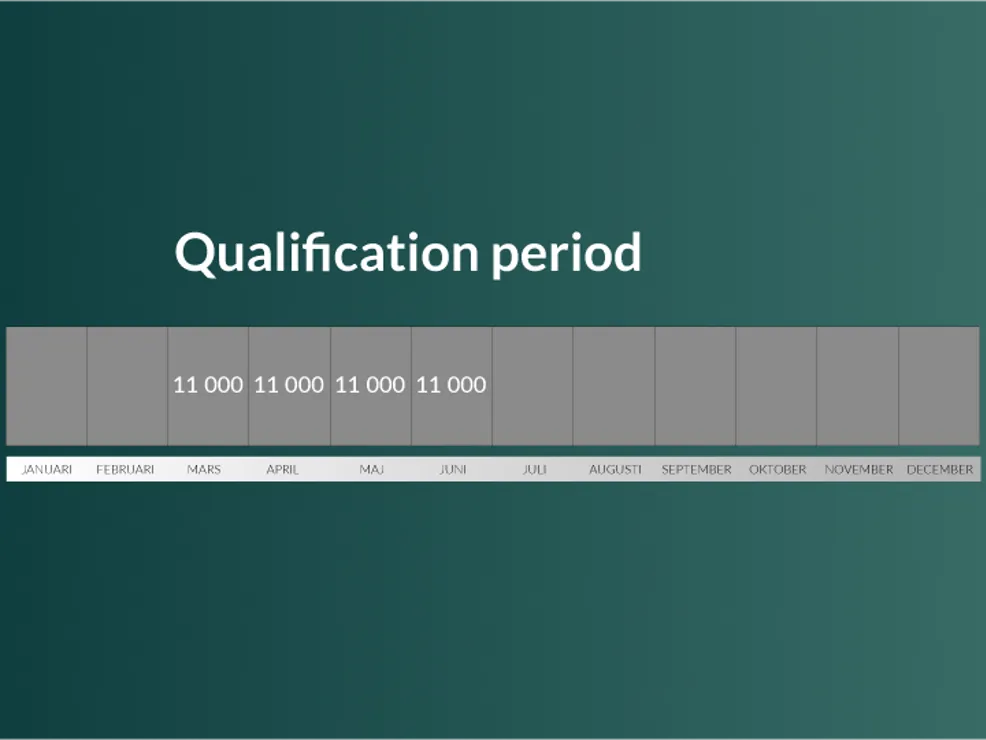

The income requirement is met if you have earned at least 120,000 kronor gross (before tax) during the 12 months of the qualification period. You must also have earned at least 11,000 kronor in 4 of those months.

To meet the income requirement under the main rule, you must fulfill both point 1 and point 2:

Total income during the qualification period of at least 120,000 kronor before tax.

At least four individual months with income of at least 11,000 kronor per month.

Alternative rule

If you do not meet the income requirement under the main rule, the alternative rule will be tested. Then you must have worked four consecutive months with at least 11,000 kronor in monthly income during the qualification period.

Income data is available at Skatteverket

For the income requirement, you may include income from gainful employment that is registered with Skatteverket. You may include everything taxed as employment income, such as salary and other benefits like lunch benefits.

You can check how much you have earned by logging in to Skatteverket. When the unemployment fund assesses the income requirement, we can retrieve the data directly from Skatteverket. To view monthly income, choose the option “Utbetalare.”

Log in to mina inkomstuppgifter at skatteverket.seSelf-emplyed

Self-emplyed must meet the same income requirement, i.e., 120,000 kronor, 4 months with 11,000 kronor in salary. For self-employed individuals, income for which self-employment contributions are paid is counted.

At least 20 years old

According to the new law, you must be at least 20 years old to receive benefits from a-kassan.

What should you do?

Register at arbetsförmedlingen.se.

Apply via Mina sidor at akademikernasakassa.se.

Check your data in Mina inkomstuppgifter at skatteverket.se.

Submit your monthly application in Mina sidor at akademikernasakassa.se.

Submit your activity report to Arbetsförmedlingen.