These rules will take effect on October 1, 2025.

We begin by determining your qualification period

The qualification period is the 12-month period during which you must meet the income requirement, and the income earned during this period forms the basis for the benefits you may receive. It starts the month before you register with Arbetsförmedlingen and stretches 12 months back in time. If there are months during which you were unable to work due to, for example, illness, caring for a child, or studies, the ramtid is extended by the same number of months.

Read more here about what can extend the qualification period.

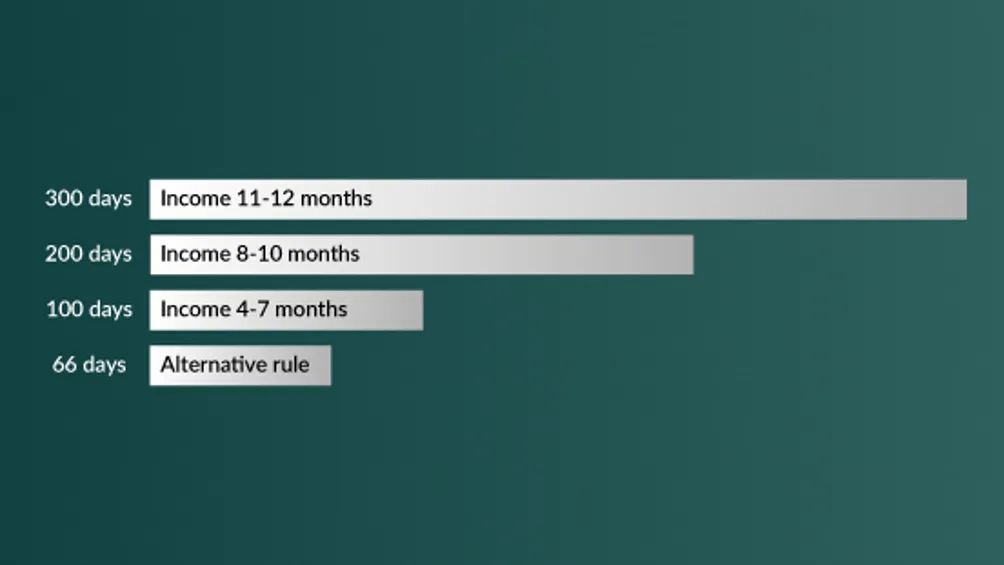

Length of the benefit period

The length of your benefit period depends on how many months during the ramtid you earned at least 11,000 kronor — the more months with qualifying income, the longer the period. The maximum is 300 days. Those who meet the alternative rule (4 consecutive months with at least 11,000 kronor per month) can receive benefits for a maximum of 66 days. If you are fully unemployed, you typically receive benefits for about 22 days per month.

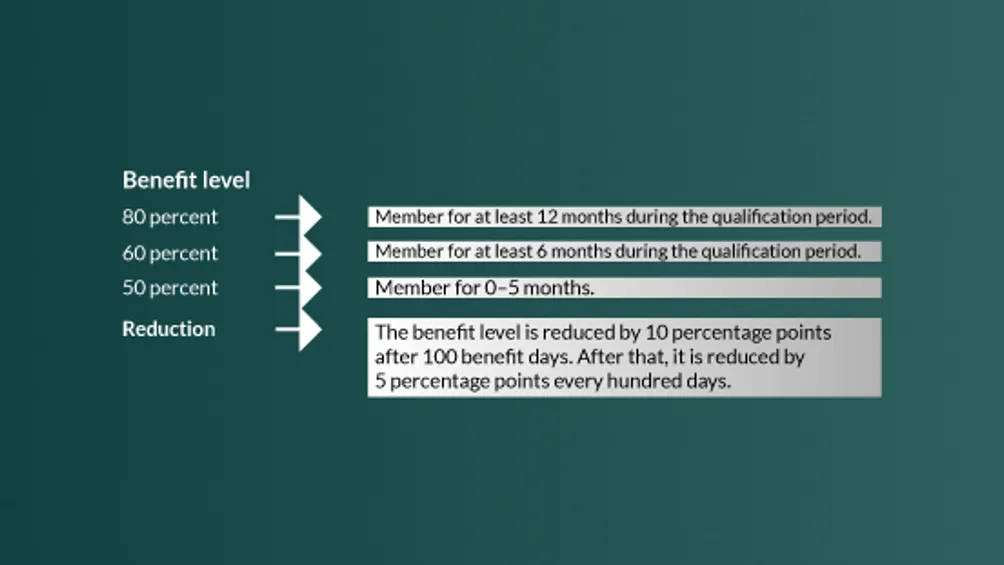

Benefit level – 80, 60, or 50 percent

To receive benefits, you must be a member of an a-kassa. If you missed joining earlier, you can still do so when you become unemployed. However, it’s best to join as soon as you start working, since the length of your membership determines the benefit level you may receive. To qualify for the highest level, you must have had continuous membership throughout the entire qualification period.

80 percent: At least 12 months of continuous membership and membership throughout the qualification period.

60 percent: At least 6 months of continuous membership. The membership must also cover at least 4 months with an income of 11,000 kronor per month.

50 percent: 0–5 months of membership.

The benefit level decreases every 100 days

The benefit level is reduced by 10 percentage points after 100 benefit days, and then by 5 percentage points every additional 100 days.

Maximum possible benefit

The most you can receive from the a-kassa is a benefit period of 300 days and 80 percent of 34,000 kronor. 34,000 kronor corresponds to an annual income of 408,000 kronor. This gives a maximum benefit amount of 27,200 kronor before tax, valid for the first 100 days of unemployment. After 100 days, the benefit level is reduced by 10 percentage points, and then by 5 percentage points every additional 100 days.

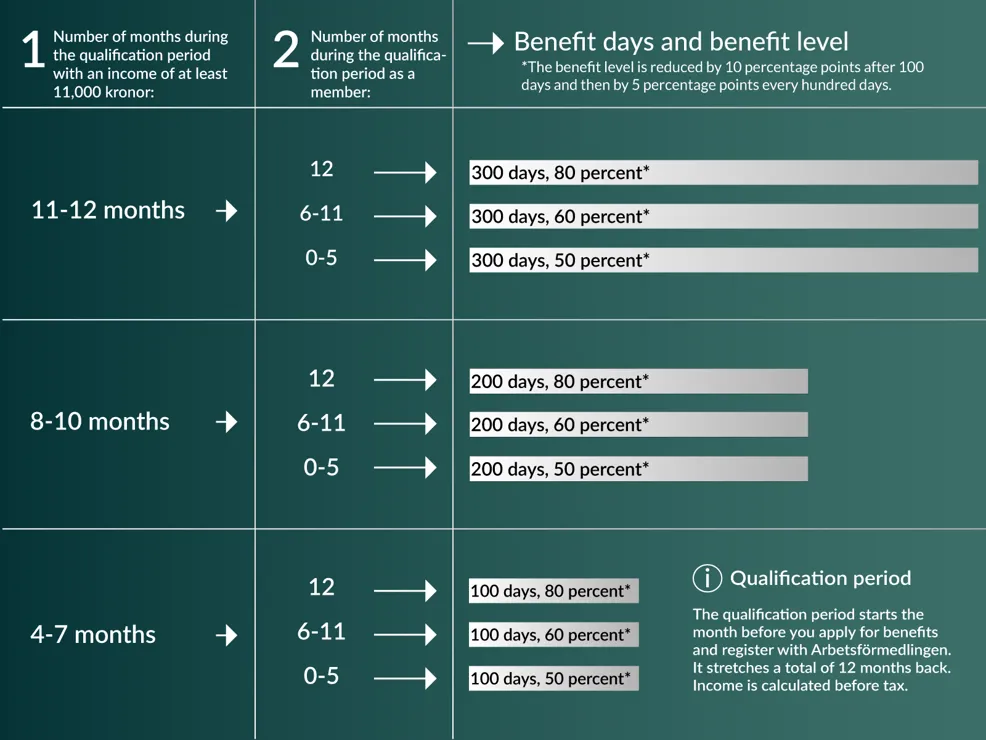

How much you can receive

Calculate number of months – Find out how many months during the qualification period you had an income of at least 11,000 kronor and choose the correct row.

Select your membership duration – Indicate how long you have been a member of the a-kassa.

See your benefit – Get an overview of how many benefit days you can receive and what benefit level applies to you.

You can receive up to 80% of 34,000 kronor for 300 days.

Monthly payments and reductions

Unemployment benefits are calculated and paid out monthly in arrears.

Monthly payments are reduced if:

you have had income from work,

there were days during the month when you were not available for work, or

you received a sanction for not fulfilling your job-seeking obligations.

How the monthly payment is reduced:

If, for example, you were sick or caring for a child, the benefit is reduced by 1/22 for each day you were unable to work.

The same rule applies to all days of the week, including Saturdays and Sundays.

If you have worked, you must report your income to the a-kassa, which will calculate the reduction.

Monthly applications must not be older than three months.

Per has worked full-time

Per has been a member of the a-kassa for 4 years, worked full-time for two years, and had an average salary of 40,000 kronor per month when he became unemployed.

He is eligible for a benefit period of 300 days. For the first 100 days, he is entitled to 80% of 34,000 kronor.

Later, Per gets a part-time job where he earns 20,000 kronor per month.

His income loss is then 50% (20,000 / 40,000 = 0.5).

50% is deducted from the maximum benefit base of 34,000 kronor, which equals 17,000 kronor.

Per can therefore receive 80% of 17,000 kronor, which is 13,600 kronor before tax per month from the a-kassa, in addition to his salary of 20,000 kronor.